Just the other day I was chatting with my coworkers about how we are having extra family guests this year for the holiday season. It made me realize just how close the holiday season really is and just how much I have to do! After summer comes to a close, the hustle and bustle of school starting, Halloween, Thanksgiving, and Christmas tend to rush up on us before we even know what has happened. And with two kids, a husband, and a business to run, I have my hands full.

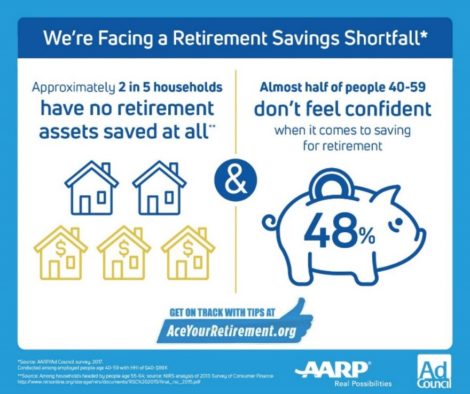

As we grow closer to the end of yet another year many of us begin to start planning our “New Year resolutions.” The things we wish that we had taken the time to do this year, but likely did not make it happen. For some of us, that means we are thinking more and more about taking stock of our financial situations. It’s tough being pulled in so many directions – children’s college funds, vacation and family outings, home ownership – not to mention holiday shopping and travel. But it’s important not to neglect to save for your retirement years.

Most of us like to think that we are experts in whatever field we might be in – and we probably are. But, unless you are an expert in the field of money or finance, you probably do not spend every day thinking about how you can make your money work harder for you. And while most people do not have their own financial planner, that does not mean that you have to do without any financial planning. We are perfectly capable of making a solid retirement plan in the age of technology and resources that are simply a click away.

Saving for retirement can feel daunting, but you can do it. Using resources like AceYourRetirement.org you can get personalized, simple tips on how to jumpstart your retirement savings and make sure you are on track. It was so helpful for me to see a couple steps I could take today to help make sure my family is on track for a more secure financial future. We have always been good with financial planning – my parents were very good teachers when it came to savings and building a solid financial future. But even knowing what I knew then and what I know now, it never hurts to revisit the plans you have in place to see what might benefit from an improvement here and there. Sometimes just one simple change can really make an impact on your savings.

Taking steps to take control of your retirement planning could have a positive impact in many areas of your life. According to a recent survey from AARP and the Ad Council, more than half of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed (54%). And 46% would be happier knowing they are taking care of their family’s future.

After just a 3-minute Q&A with Avo at AceYourRetirement.org I have a few actionable steps that I can take to step up my retirement planning game! We’ve been savvy with our money I know we are capable of achieving large financial goals. But learning more and having as much knowledge as possible can really make you feel more confident when dealing with your retirement plan.

Where will you start with your retirement planning? What’s your biggest challenge today?

Here are a few tips to consider to help you maximize your retirement savings:

- While gathered with your family for the holidays, discuss your savings plans and retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- Start planning now what age you plan to retire and when you plan to start taking your Social Security benefits. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal part-time work

- Visit AceYourRetirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo?, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.